Despite renewed enthusiasm in make-up in 2021 after a dismal 2020, a prolonged recovery of the US colour cosmetics market is expected, as consumer behaviour and spending shifts evolve. Euromonitor International will highlight opportunities in colour cosmetics, while also outlining challenges the market faces moving into 2022.

Colour cosmetics expected to make palpable rebound in 2021, followed by extended recovery

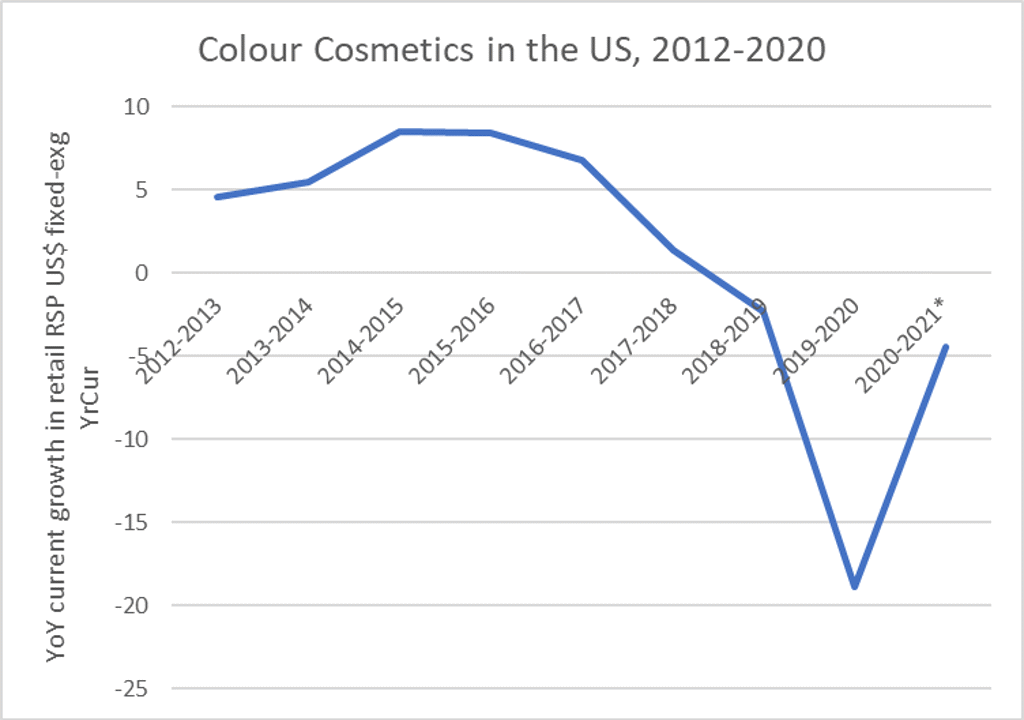

Colour cosmetics was the most negatively impacted beauty and personal care category in the US in 2020, having declined by 19% in current and constant terms in 2020. Work-from-home arrangements, significant reduction of social occasions, and gradual cannibalisation from skin care over the past several years resulted in less resilience for the category.

*Note: 2020-2021 growth is a projection, as of August 2021, and not considered final data at the time of reporting.

In contrast to markets in rapidly-growing Asia Pacific and stable demand in Latin America, pre-pandemic the US was experiencing a deceleration in demand. Softening (but still positive) growth in colour cosmetics from 2017 to 2019, following a hyper-cycle of consumption from 2012-2017, suggests a longer post-COVID-19 recovery timeline, since low 2019 baselines contributed to even steeper declines in 2020. On the positive side, 2021 growth estimates, at the time of reporting, are reaching close to 2019 levels. However, habit persistence of wearing no or less make-up, the current aesthetic for a “no-make-up make-up look”, and other consumer-driven trends evoke changes in the type of colour cosmetics experiencing post-pandemic demand.

Colour cosmetics brands scale back to adjust to changing consumer needs

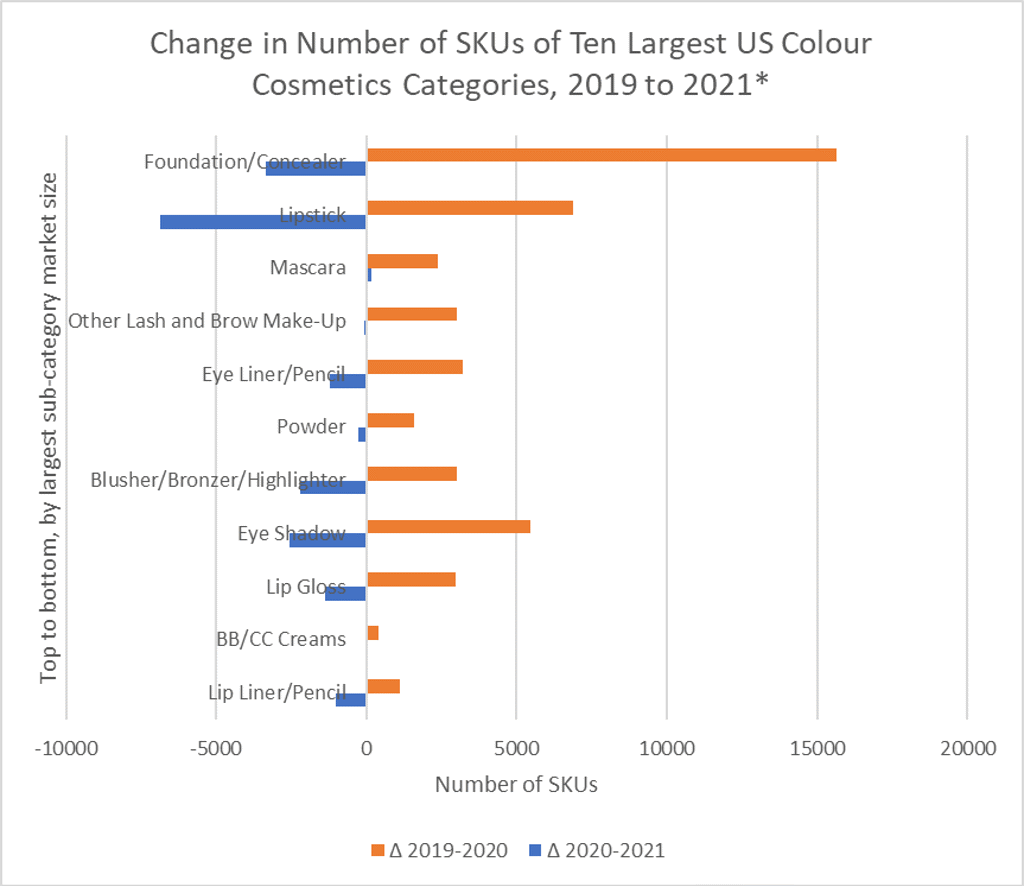

2021 quarterly data from the largest colour cosmetics players suggests that performance lagged behind expectations. As a result, cosmetics brands have been adjusting their product portfolios to adapt to fluctuating consumer demand. To identify those categories that are faring better than others, Euromonitor International analysed changes over time in the number of online SKUs of the 10 largest colour cosmetics categories in the US, using data from its Via Online Pricing sample.

*Note: Yearly sample periods gathered SKU data from 1 January to 12 September of that year, in order to cross-compare change over time with latest data.

In the largest colour cosmetics category for the US, foundation/concealer, the additional number of online SKUs added from 2019 to 2020 dwarfed the other top 10 categories. However, brands reduced online SKUs from 2020 to 2021, a shift also seen in eight of the leading 10 colour cosmetics segments. While lipstick’s online SKUs witnessed the second-largest drop, mascara saw some added online SKUs from 2020 to 2021, suggesting newer entrants or product line expansions. These insights suggest that despite depressed demand for colour cosmetics, new product launches are occurring, but players need to shift investment and resources towards the higher-performing categories.

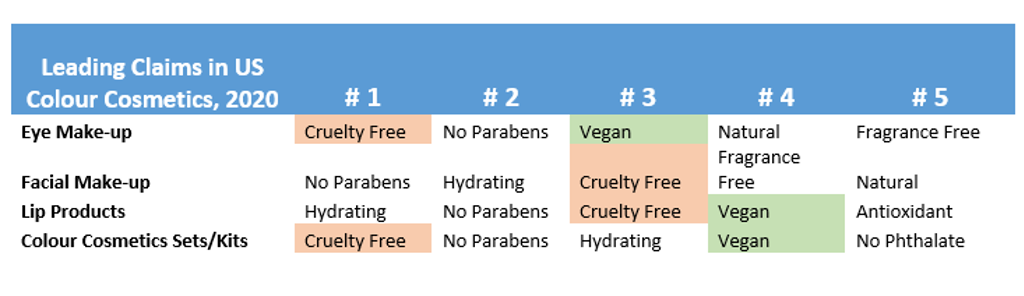

Opportunities exist in “cruelty-free” and “vegan” claims, which are especially prevalent in the US

Euromonitor International’s Product Claims and Positioning system found that clean, dietary and health, and ethical labels have been growing importance in colour cosmetics. In stark contrast to 15 years ago, when many of these labels would have been limited to premium or niche brands, “vegan” and “cruelty-free” claims stand out in the US from both mass and premium colour cosmetics players, a tangible result of the industry’s movement towards wellness.

Note: Rankings organised by number of SKUs with claim in the US by category.

Vegan beauty in the US is driven by colour cosmetics, which is the largest in the world. The US beauty industry is less regulated than regions such as Western Europe and parts of Asia, so consumers rely on the vegan beauty claim to act as a screener for products they might consider “unsafe”. While vegan beauty was originally driven by independent brands, its influence has trickled down to premium offerings; for instance, the relaunched range of Kylie Cosmetics, which as of July 2021, contains no animal oils, parabens or gluten.

Pockets of growth found in collaborations, packaging, and formulation changes

Consumers are still attracted to newness, so limited-edition collaborations may also help stimulate interest while also keeping inventory lean as witnessed with the NYX Professional Makeup + Netflix’s Sex Education collaboration. Hair care personalisation brand Madison Reed is tapping into multifunctional products; its Great Cover Up pressed powder can be used to temporarily touch up roots in the scalp, as well as fill in brows. “Skinifying” colour cosmetics is also gaining momentum, due in part to the consumer movement to streamline routines and find multi-benefit, cross-category items. Launching fewer SKUs and focusing only on hero products is also a way to control inventory and expand profit margins. Debuting mini-sizes at more accessible price points may also attract consumers who are using less make-up and be a feasible pivot for premium players. Rising sustainability awareness among consumers also creates prospects for colour cosmetics brands to incorporate a wide array of features that meet the three broad pillars of sustainability: social (support of BIPOC-owned brands), environmental (such as free-from formulations) and financial (Fairtrade ingredients) sustainability.

Personalisation, digitalisation, and sustainability as inspiration for future growth

With channel dynamics forever changed by COVID-19, digitalisation will be a pivotal area of innovation for colour cosmetics players in the following ways: 1) as a complement to the in-store experience (such as skin diagnostics and shade matching tools), 2) as a tool for the online shopping experience (virtual try- on, virtual consultations), and 3) a means of fulfilment through e-commerce (hyperlocal delivery service, kerbside collection). Euromonitor International’s Digital Consumer survey data revealed an uptick in online activity via a computer or tablet as a way to research beauty and personal care alongside a notable reduction of in-store shopping from 2020 to 2021, highlighting that digital will act as a bridge between the in-store and online path to purchase.

Future outlook for the remainder of 2021 and into 2022

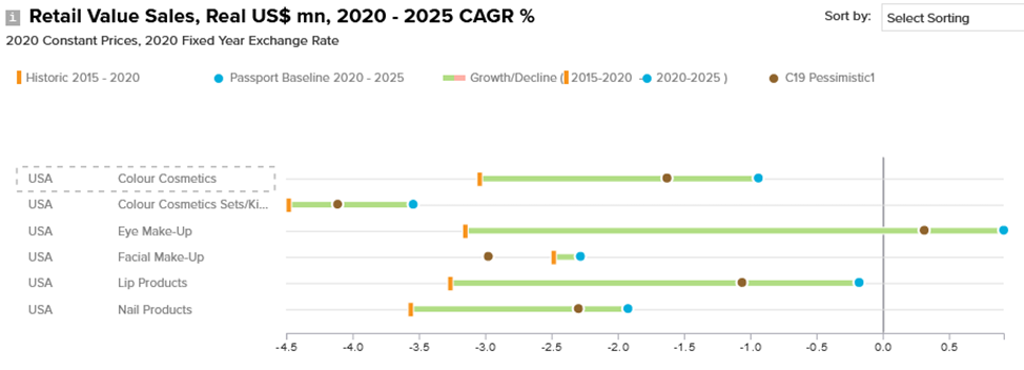

Source: Euromonitor International Industry Forecast Model, updated 31 August 2021

After plateauing from rapid vaccine distribution, the US is in the midst of another wave. Despite this, out-of-home occasions (and colour cosmetics usage occasions) have resumed and business and travel restrictions have relaxed to some extent. Consumer confidence in discretionary spending has improved considerably since 2020. Amid the looming holiday season, US consumers desire a respite from pandemic-related fatigue, giving colour cosmetics brands a chance to be seen as a symbol of celebration, indulgence, or self-care. The US colour cosmetics market will eventually recover, but this is likely to be elongated.

A version of this article was published in Global Cosmetic Industry on 1 November 2021.