In 2020, the population of the world’s top three wealth segments – ultra-high net worth individuals (ultra-HNWIs), high net worth individuals (HNWIs), and affluent – are set to decline by 4.8% collectively over a year earlier. The wealthy and affluent are not immune from the financial impact of the Coronavirus (COVID-19) pandemic and this decline will adversely affect businesses relying on the wealthy and affluent consumer base.

The contraction is expected to be greatest for the ultra-wealthy segment (comprising adults with total wealth exceeding USD50 million) at 6.5% year-on-year in 2020, compared to a decline of 5.5% forecast for the HNW segment (comprising adults with total wealth exceeding USD5.0 million but below USD50 million) and 4.7% for the global affluent population (comprising of adults with total wealth exceeding USD1.0 million but below USD5.0 million). Prices for many types of assets including properties, stocks and shares have fallen in many markets as a result of the pandemic, impacting the net worth of wealthy and affluent people.

Asia Pacific and Australasia are the most resilient regions

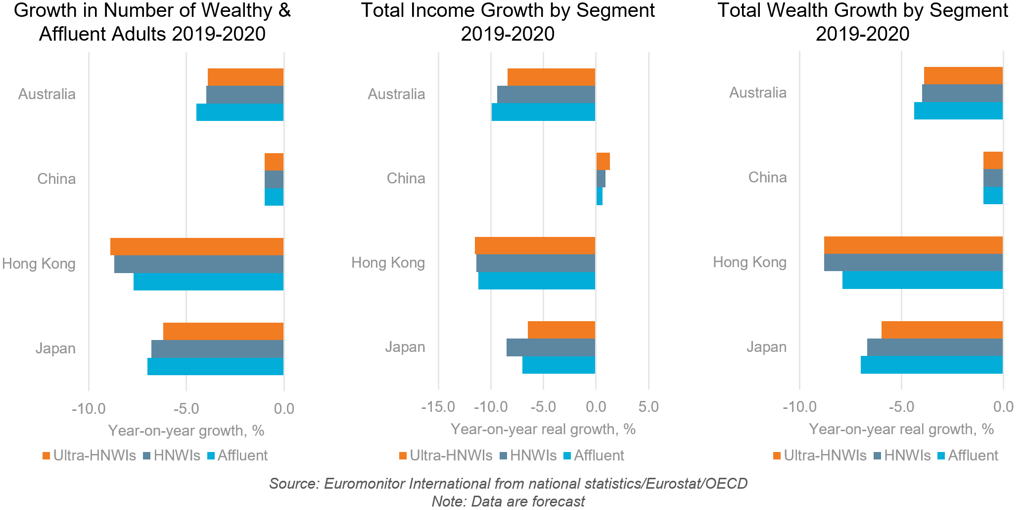

Of all global regions, Asia Pacific and Australasia are the most resilient regions, where decline in the wealthy and affluent population is expected to be the smallest in 2020, compared to a year earlier. The region’s resilience is largely due to the strength of China’s economy, which has recovered fully to pre-pandemic levels as of Q3 2020.

In 2020, the number of ultra-HNW, HNW and affluent adults across Asia Pacific and Australasia’s key wealth markets is expected to decline significantly compared to a year earlier, although the decline in China will be the smallest thanks to the country’s economic recovery which was already in full swing in Q3 2020. China will also be the only key market where wealthy and affluent consumers can still expect to enjoy positive, albeit modest, real income gains in 2020.

Asia Pacific and Australasia’s Wealthy and Affluent Population: 2019-2020

China’s wealthy likely to face a significant downturn in a pessimistic scenario

Even though China’s economy has rebounded to the pre-pandemic level and the country’s wealthy and affluent adults are set to enjoy real income gains in the baseline (most likely) outlook for 2020, there remain risks to the downside in Euromonitor’s range of alternative COVID-19 pessimistic scenarios.

In the C19 Pessimistic1 scenario, which is slightly more pessimistic than the baseline scenario, and where there is a major second global pandemic wave in 2020, followed by a possible third wave in 2021, China’s wealthy and affluent population as a whole is set to fall by nearly a quarter (24.8%) in 2020 over a year earlier and is not expected to rebound to the 2019 level until 2024. In comparison, in the baseline outlook, the country’s wealthy and affluent population is expected to fall by 1.0% year-on-year in 2020 (which is a very modest decline relative to other key markets) and is on course to expand by 30.4% in the 2019-2024 period.

Impact on the luxury industry

In recent years, the luxury industry has faced threats of a trade war, increased global economic uncertainty, shifts in consumer behaviour and values, and huge advances in digital technology. This has led to significant challenges across the luxury landscape. However, nothing in the modern evolution of the luxury industry (and that includes the global financial crisis) compares to the global disruption that we are now seeing caused by the COVID-19 pandemic.

Amid weak economic conditions, a falling number of wealthy and affluent consumers globally, and lockdowns and social distancing measures forcing stores to close, the global luxury market is set to contract by 16.0% year-on-year in real terms to be worth USD899 billion in 2020. In comparison, by the end of 2019 prior to COVID-19, global luxury sales exceeded the USD1.0 trillion mark with an additional 3.0% annual real growth expected for 2020. Given Asia Pacific accounts for over 40% of global luxury goods value sales, any contraction in the region’s wealthy and affluent population, as well as its wealth overall, could have a huge material impact on demand for global luxury goods and services.