Seoul, South Korea – A landmark report by market research company Euromonitor International has found that sales of C-beauty brands among top 20 brands in colour cosmetics have increased from 14% in 2017 to 28% in 2022 with the aid of digital capabilities, especially during the COVID-19 pandemic in China.

Including in-depth analysis on C-beauty brands and China’s beauty and personal care market, Euromonitor International’s Uncovering C-Beauty: Growth Strategies and Market Outlook report identified and explored three key categories – (1) the rise of C-beauty, (2) C-beauty seeks to diversify growth capabilities, and (3) outlook and implications.

“Dupe” identity torn down by highly educated consumers on ingredients and digital power

In the past, consumers perceived C-beauty as the “cheaper substitute” or “dupe” for international brands. In the past five years, multi-brand C-beauty companies such as Jala and Proya have shown potential through new product development and marketing strategies targeting younger generations, while emerging new brands such as Winona and Florasis have pushed ingredient and product format innovation.

Zooming into consumer trends by claim, Euromonitor research indicated that Chinese consumers desire skin brightening the most across all generation groups. Anti-blemish is the second most desired product feature for Gen Z in China, with many top players at the forefront of this.

A ‘digital first’ environment has also maximised C-beauty's growth, as the e-commerce penetration rate of beauty and personal care products in China reached 42% in 2022. From brick-and-mortar traditional brands to social selling-dominants brands, a large part of sales of C-beauty brands was generated by online engagement and live commerce activities of top influencers.

C-beauty faces a challenge on lower brand loyalty and awareness

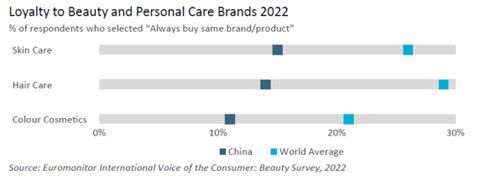

While C-beauty brands have shown strong growth momentum, the obstacle of short-life cycles remains a challenge. According to Euromonitor’s Voice of the Consumer: Beauty Survey 2022, Chinese consumers have relatively lower brand loyalty compared with the world average.

The survey shows only 11% of the respondents always buy the same brand/product when it comes to colour cosmetics products. Euromonitor believes this is a significant challenge for C-beauty brands to maintain performance and position their brands. With many affordable alternatives in the market, consumers easily switch to other options once the brands suspend advertising or livestreaming shopping promotions.

This is a significant challenge for C-beauty brands to maintain performance in the long-term. With fierce competition in China's domestic market, C-beauty brands are in desperate need of new opportunities and going overseas.

However, the lower awareness of C-beauty remains a challenge. Globally, the awareness of K-beauty and J-beauty is over 30% and 20% respectively, whereas C-beauty is only 13%. The mature and efficient manufacturing network in China has led to a lower entry barrier for beauty brands. Compared to K-beauty and J-beauty, the image of C-beauty is still vague and not powerful enough to naturally form a distinct identity in consumers’ minds. To tackle this challenge, some C-beauty companies have tried to attract consumers in western markets by offering affordable prices and diversified choices.

Premium “C-scent” is the next blue chip

Consumers tend to choose value for money and good quality products rationally; brands could benefit by focusing more on substantive innovations and resonating with a strong brand story to develop as distinct labels in the minds of global consumers.

Exploring market potential in a new category is one of the solutions. Premium fragrances is an unmet category and will become the next sector to see more C-beauty brands thriving. Riding on a trend that China's young middle-class consumers crave a richer expression of a sophisticated lifestyle in their daily lives, the potential in China’s fragrance market is growing with the highest CAGR over 2022-2027, with 15%.

Yang Hu, Insight Manager – Health and Beauty in Asia at Euromonitor International, said:

“To jump the hurdle from ‘affordable product’ to ‘powerful brand’ and eventually enable ‘C-beauty’ as an influential label to feed more Chinese brands is still the challenge. Now it’s time to tear off the “dupe” label. By targeting premiumisation with exploring new beauty sectors, C-beauty brands will have solid competitiveness for building longer lifecycle C-beauty brands and a further global expansion beyond China”.

For more insights, visit Euromonitor’s Insights page.

NOTES TO THE EDITOR:

- C-beauty brands are mainly offered at mass price points (under USD30), with the mass beauty and personal market in China predicted to record a CAGR of less than 1% over the forecast period.

- The e-commerce penetration rate of beauty and personal care products in China was 43% in 2022, with more than 50% of millennials using livestream/live selling platforms to purchase beauty and personal care products.

- According to Euromonitor International’s Voice of the Consumer: Beauty Survey 2022, globally, including China, the awareness of K-beauty and J-beauty is 30% and 22%, respectively; the awareness of C-beauty is 13%.

- According to Euromonitor's Voice of the Consumer: Lifestyles Survey 2023, 31% consumers make purchases based on brands’/companies' social and political beliefs; this figure is 33% for Gen Z.